Central bank of india cif number: The central bank of India is one of the oldest serving banks which is owned, managed and run by the government. The central bank of India has a network of 4600+ branches, 10 satellite offices, and one extension counter. The central bank is an independent authority that handles monetary policy which plays a very important role in the functioning of an economy. Most of us are well aware of its role and responsibility few of them are mentioned, just have a look.

- Provide financial service.

- Helps in economic research.

- Regulate banks.

- Controlling the supply of money in the economy.

- Controlling the cost of borrowing.

NET BANKING

With the advent of internet banking, all banks have gone through unimaginable changes over a period of time. All banks in the country including CBI (Central bank of India) have witnessed such changes which further led to an overall improvement in the working of banks. Keeping aside these points customers prefer to operate online rather than visiting their home branches as they find it more helpful and handy than offline.

Also one of the main key features enjoyed by a customer using net banking is the CIF number. CIF stands for Customer information file number it’s a unique number that is allotted to every customer or account holder having their account in banks.

In this write up we gonna show you various approaches you can use to check your CBI CIF number but before that, you need to know about the CIF number and why it is important.

Contents

ALL YOU NEED TO KNOW ABOUT CIF AND ITS USE-

- CIF (CUSTOMER INFORMATION FILE): Customer information file number is an 11 digits unique number assigned to every account holder having their account in banks. Every bank allots this number to their customers, as it contains sensitive information about the account holder. CIF number is used by banks to retrieve information about the customer and the type of account he/she is handling.

- USE OF CIF NUMBER: CIF number is used to check the detail of the account holder and toview the customer account by relationship. CIF comprises various information of account holders like name, address, DOB, KYC information, Demat account, and id proof as well.

HOW TO CHECK YOUR Central bank of india cif number?

CIF number helps in availing various services both online as well as offline, but you must be known to your CBI CIF number. If you are not aware of such a number what you need to do is go through this guide as we are going to show you various ways you can use to check your CIF number both online and offline.

ONLINE METHODS:-

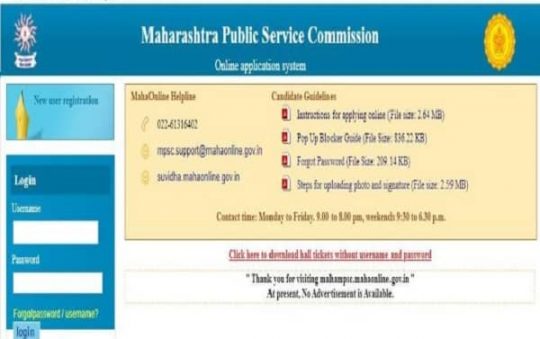

- NET BANKING

- Turn on your net connection.

- Select your browser.

- Then open up google and write CBI bank in the search option.

- Click on the very first result displayed on your screen or you can directly visit by tapping on the portal mentioned in the next step.

- Portal – http://www.centralbank.net.in/

- Post visiting enter your username and password

- Now you will notice your CIF number under the accountholder name.

- USING CENTRAL BANK OF INDIA APPLICATION

- First what you have to do is download and install the application on your device.

- Allow unknown sources under the setting head to enjoy the application.

- Post-installation head to the login option.

- After login your username and password you will be on your homepage.

- On the homepage, various options will be there to choose a user profiles.

- Then you will easily see your CBI CIF number.

Also read: How To Deactivate Jio Sim Temporary or Permanently?

OFFLINE METHODS:-

- VISITING YOUR CBI BRANCH

If you want to know your CIF number you can also use this approach to view your number, sometimes people find difficulty in net banking maybe because of lack of knowledge or difficulty in finding CIF number using the above two approaches or due to network failure or can be said that not stability in net. In such cases what you can do is simply visit your branch and ask your CIF number.

Point to remember: – Always carry necessary documents at the time of visiting your CBI branch-like your passbook, or even you can carry chequebook and also your id proof to confirm your identity.

- CHEQUEBOOK

This one is the best method if you don’t know how to view your number using the online method then simply open up your chequebook and on your very first page, you will see your CIF number on the top of the page.

But this method is applicable only you have chequebook otherwise you need to first issue then you can go use this approach.

- PASSBOOK

This approach is as same as chequebook as the easiest and fastest and most used method to check your CBI CIF number. Bank always issue passbook whenever you open your account with any bank as it is the first step for every bank to issue a passbook so that accountholder can check necessary details. It is not like chequebook that you need to wait for a week or days to get your chequebook.

So what you need to do is open up the very first page of the passbook just above your passbook you will see your information number.

IS THERE ANY WAY TO CHECK YOUR CBI CIF NUMBER RATHER THAN ABOVE METHODS?

Yes, there are two more ways to check or get details about your number. The first one is by calling them and another one is through a statement.

In case if you find hardship in any mention method just simply dial the number and ask your CIF number but they will ask for some details which you need to provide them to confirm your identity as it is the procedure of every bank to confirm customer identity before giving details of the account holder.

Number to contact– 1800-22-1911 (toll free)

Sometimes there may be a network issue or line is busy what you can do is orders an account statement to check your CIF number which is printed on the first page of the statement.

SUMMING UP

In the above guide, we have discussed various ways you can go with if you want to check your number and avail of some service. These are the best method you can use to obtain the information you want.